FNS40615 – CERTIFICATE IV IN ACCOUNTING

RPL & Skills Recognition Classroom Based Training

CRICOS Course Code: 088794M

Overview

This qualification reflects accounting job roles in financial services and other industries requiring accounting support functions. Individuals in these roles apply theoretical and specialist knowledge and skills to work autonomously and exercise judgement in completing routine and non-routine activities.

Outcomes

Career Opportunities

This qualification reflects accounting job roles in financial services and other industries requiring accounting support functions.

- Accounts Assistant

- Accounts Payable Clerk

- Accounts Receivable Clerk

- BAS Agent

- Bookkeeper

- Payroll Clerk

Pathways

Upon successful completion of this qualification you can undertake further study in FNS50215 Diploma of Accounting, or a range of other Diploma Qualifications which we offer. Further information on this qualification can be found by visiting www.training.gov.au

(FNS40615 – Certificate IV in Accounting).

Course Details

Entry Requirements & Pre-Requisites

There are no formal entry requirements for this qualification, however:

- Successful completion of HSC (Higher School Certificate) or its equivalent

- For international students, it is required that applicants must have passed the IELTS test with at least 5.5 overall score, with no score below 5.o in any skill area

- Alternatively, prospective international students must have completed a 2-year study in Australia or must have passed a General English course with Intermediate proficiency level.

- All participants will be required to undertake a language, literacy and numeracy (LLN) assessment prior to undertaking training to ensure they have the required skills to undertake training at this level

- For online delivery you will require access to a computer, internet connection and email, appropriate software (Microsoft Word and Excel or similar) and range of commonly used business equipment (photocopier, faxes, binder, telephone, answering machine)

You may be required to access an actual workplace or simulated environment to undertake assessment tasks depending on the elective units selected

There are no pre-requisite units for this qualification.

For additional information regarding the specific units listed please visit www.training.gov.au (FNS40615 – Certificate IV in Accounting).

Pre-Requisites

There are no pre-requisite units for this qualification.

For additional information regarding the specific units listed please visit www.training.gov.au (BSB40215 – Certificate IV in Business).

Unit Outline

- BSBFIA401 – Prepare financial reports

- BSBSMB412 – Introduce cloud computing into business operations

- FNSACC311 – Process financial transactions and extract interim reports

- FNSACC312 – Administer subsidiary accounts and ledgers

- FNSACC408 – Work effectively in the accounting and bookkeeping industry

- FNSACC416 – Set up and operate a computerised accounting system

- FNSTPB401 – Complete business activity and instalment activity statements

- FNSTPB402 – Establish and maintain payroll systems

- BSBACC413 – Make decisions in a legal context

- BSBITU306 – Design and produce business documents

- BSBITU402 – Develop and use complex spreadsheets

- FNSACC414 – Prepare financial statements for non-reporting entities

- FNSACC313 – Perform financial calculations

Licensing/Regulatory Information

This qualification reflects accounting job roles in financial services and other industries requiring accounting support functions. Individuals in these roles apply theoretical and specialist knowledge and skills to work autonomously and exercise judgement in completing routine and non-routine activities.

Licensing/Regulatory Information

There is no direct link between this qualification and licensing, legislative and/or regulatory requirements. However, where required, a unit of competency will specify relevant licensing, legislative and/or regulatory requirements that impact on the unit.

Persons providing a business activity statement (BAS) service must be registered by the Tax Practitioners Board and this qualification is currently cited as meeting the educational requirements for registration. Other conditions apply including a designated period of experience. Persons seeking BAS agent registration should check current registration requirements with the Board as this is reviewed regularly. Additional eligibility criteria may apply.

Visit www.tpb.gov.au for further information.

LLN & Computer Literacy – Help!

At Australian Institute of Innovation and Technology we understand that not every person learns the same way or at the same pace. That’s why when you do this course with us, we will ensure that we identify and attend to any Language, Literacy or Numeracy shortfalls you may have. We will also look at your computer skills and literacy and ensure that you are at a level that is suited for the course, and if not, then we will dedicate additional time and effort to bring you up to speed. Before commencing any of our courses you are required to sit an LLN assessment and may be asked about your computer habits and required to complete some foundational computer skills. This is exercise will help us to identify any LLN or computer skill shortages you may have and make sure that we are able to help you to get up to speed.

Credit Transfer

Credit Transfer involves the awarding of credit towards a qualification, granted to participants on the basis of outcomes gained through participation in courses with another RTO.

Credit Transfer can be granted for one or more units which make up the units in a qualification or accredited course with AIIT.

If you believe you are entitled to Credit Transfer, please discuss this with your Trainer/Assessor who will assist you.

International Students

CRICOS DURATION: 52 weeks

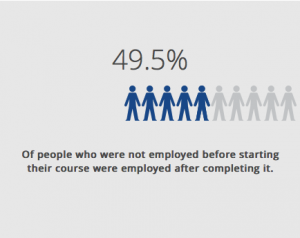

Employment

Information sourced from: http://www.myskills.gov.au/courses/details?Code=FNS40615

Information sourced from: http://www.myskills.gov.au/courses/details?Code=FNS40615

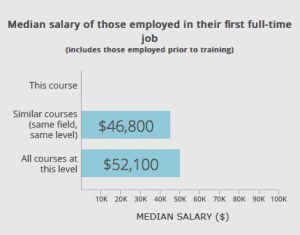

Information sourced from: http://www.myskills.gov.au/courses/details?Code=FNS40615

Information sourced from: http://www.myskills.gov.au/courses/details?Code=FNS40615

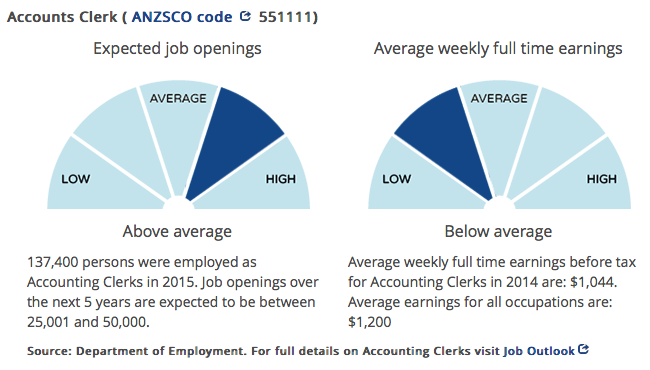

Labour Market Information

Information sourced from: http://www.myskills.gov.au/courses/details?Code=FNS40615

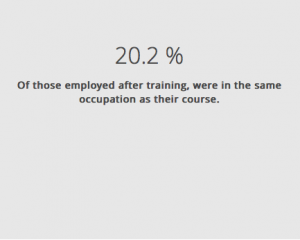

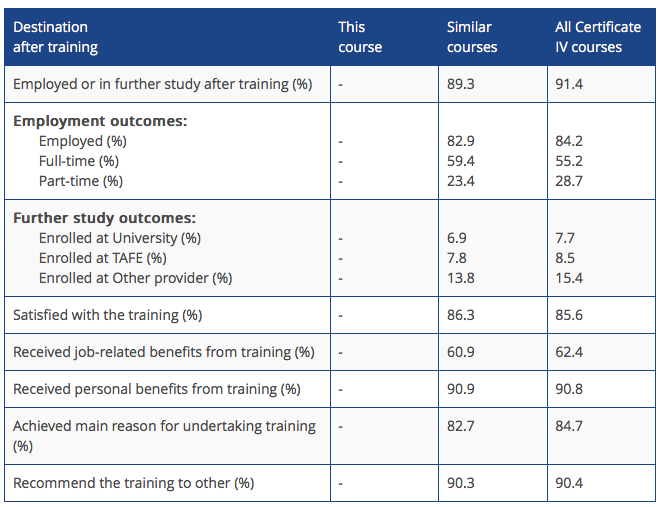

Destination After Training (of all graduates)

Information sourced from: http://www.myskills.gov.au/courses/details?Code=FNS40615

Ready to start?

Select your Delivery Mode

Candidates often commence courses and modules with existing knowledge, skills, and experience that are relevant to their field of study. These attributes may have been gained in educational or practical settings (paid or voluntary) both in Australia or overseas. Recognising a candidates’ prior learning involves giving them recognition towards a vocational qualification for the formal and informal learning experiences they have previously completed. For example, if you have previously worked in an office, you may have gained some skills that can be used as recognition toward a business administration qualification. Likewise, if you have spent time helping out at a tuition centre for underprivileged children, you may have some experience that is relevant to a teaching certification.

Essentially, RPL may mean that you do not have to complete all the modules, maybe none of them, in a given course of study to attain the full qualification.

Who Can Apply for the RPL Process?

Anyone who has previous knowledge, experience, or skills that are relevant to the course of study that they want to complete can apply for RPL, regardless of whether your training or experience was in Australia or abroad. To be successful, you need to be able to provide evidence of the skills and knowledge you have gained.

Process

1. FREE SKILLS ASSESSMENT

You need to have valid industry experience in order to qualify for this RPL program. When you first touch base, we will help you identify your skills and advise on whether this qualification is right for you. As a rule of thumb if you have more than 2 years experience in your field, then you are likely to be eligible.

2. EVIDENCE PORTFOLIO

- Certified Identification

- Resume: We need your resume showing details of your work history, job description including your duties and places you worked in.

- list showing relevant employment history

- letter of employment

- reference letters: get a reference letter from your current & past employers detailing your job title, your duties, how long you worked there and any special skills you have. Reference letters should show approximately four (4) years experience (in total).

- Certificates/ transcripts need to be certified by JP

- Work samples/change plans

- Supervisor’s reports

- Customer/client feedback

- Position description

- Response to questions/interview

- Other evidence: it’s a good idea to include any other documents as evidence.

3. SKILLS CHECK

- You will be having a conversation covering questions for each unit with our qualified assessor

- The assessor may choose to also perform a practical observation.

- Where gap training is required, you will need to complete theory or practical assessments as required. Theory components can be completed from home and practical components can be completed at your work site.

4. QUALIFIED!

All certificates are Nationally Recognised.

Duration: 45 weeks

Location: Sydney

*Currently only available for International Students